원글 페이지 : 바로가기

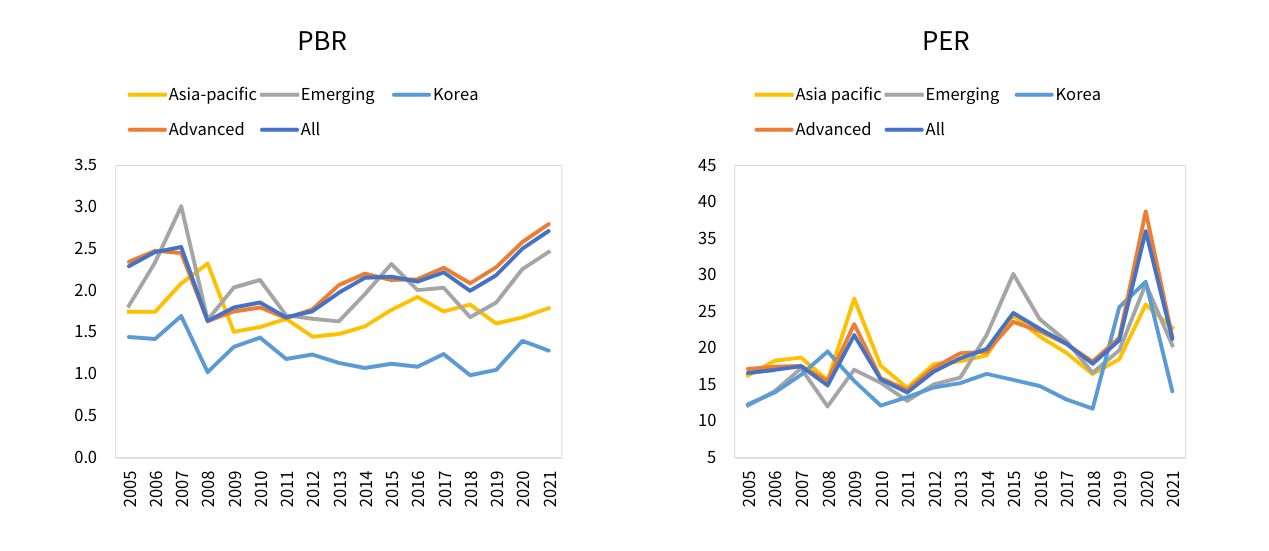

The term “Korea Discount” refers to the phenomenon where South Korean companies are valued less favorably compared to foreign companies with similar profitability or asset value. source : file:///C:/Users/eunsu/Downloads/1.%EC%BD%94%EB%A6%AC%EC%95%84%20%EB%94%94%EC%8A%A4%EC%B9%B4%EC%9A%B4%ED%8A%B8%EC%9D%98%20%EC%9B%90%EC%9D%B8%20%EB%B6%84%EC%84%9D_%EA%B9%80%EC%A4%80%EC%84%9D.pdf source : file:///C:/Users/eunsu/Downloads/1.%EC%BD%94%EB%A6%AC%EC%95%84%20%EB%94%94%EC%8A%A4%EC%B9%B4%EC%9A%B4%ED%8A%B8%EC%9D%98%20%EC%9B%90%EC%9D%B8%20%EB%B6%84%EC%84%9D_%EA%B9%80%EC%A4%80%EC%84%9D.pdf The graph above is data analyzed by the Korea Capital Market Institute, illustrating how undervalued the Korean market is compared to other countries or classifications such as developed or emerging markets. It shows that Korea is significantly more undervalued than the Asia-Pacific region or even emerging markets. The main reasons for the Korea discount are as follows: Insufficient shareholder returns Low profitability CEO-centric management culture Compared to companies in other countries, South Korean companies have a very low rate of returning profits to shareholders. source : FactSet While U.S. companies return 97% of their annual net income to shareholders (40% in dividends and 57% in buybacks), and the global average is 73%, South Korean companies return only a mere 17%. Because of this low return rate to shareholders, South Korean companies tend to accumulate a lot of capital, which leads to a lower ROE (Return on Equity). A low ROE indicates that capital is not being allocated efficiently. Furthermore, in South Korea, there is a lack of perception that “companies belong to shareholders,” and instead, there is a perception that they belong to the conglomerate families. Thus, the profits generated by companies are not distributed to minority shareholders but rather benefit a small number of major shareholders, including the conglomerate families. Due to the excessive dominance of major shareholders and the weak legal and systemic protection for minority shareholders, companies are managed unilaterally according to the preferences of the major shareholders.